Price and stock mismatches on eBay are one of the fastest ways to damage seller performance in 2026. A single mismatch can trigger cancellations, buyer complaints, and account consequences that are difficult to reverse.

For many sellers, the issue is not carelessness. It is a scale. As soon as listings grow beyond a manageable number, manual checks stop working reliably.

This guide explains how to avoid price and stock mismatches on eBay in 2026, why these errors are especially dangerous under current eBay standards, and how sellers can protect both margins and account health.

Why eBay Price and Stock Mismatches Are So Costly in 2026

An eBay price mismatch occurs when a listed price no longer reflects the supplier’s actual cost. In practice, this leads to one of two outcomes.

Either the seller cancels the order to avoid a loss, or the seller fulfills the order at a margin they never planned for. Both outcomes damage seller performance and buyer trust.

Under today’s conditions, pricing mistakes also affect advertising profitability. With updated attribution rules now in effect, margin control plays a bigger role in determining whether promoted sales are actually profitable. The eBay Promoted Listings update for 2026 explains why pricing discipline is now critical.

The 6% Final Value Fee Penalty Most Sellers Overlook

Price and stock mismatches do more than cause cancellations. They directly impact seller status.

When repeated cancellations push a seller into Below Standard performance, eBay applies an additional 6% Final Value Fee penalty on top of normal selling fees. This penalty applies across affected transactions, not just the original listing that caused the issue.

According to eBay’s official Seller Performance Standards, falling below required thresholds increases selling costs and reduces account flexibility.

For sellers operating on thin margins, this extra 6% can quickly turn viable listings into losses. Avoiding mismatches in 2026 is not optional. It is a requirement for maintaining profitability.

The Out-of-Stock Transaction Defect Explained

One of the most damaging consequences of stock mismatches today is the Out-of-Stock Transaction Defect.

This defect occurs when a seller cancels an order because the item is no longer available from the supplier. Each cancellation counts as a transaction defect, and these defects accumulate fast.

In 2026, this is one of the fastest ways sellers fall into Below Standard status. Even a small number of out-of-stock cancellations can negatively impact account health when they occur repeatedly.

Why Manual Price and Stock Checks Fail at Scale

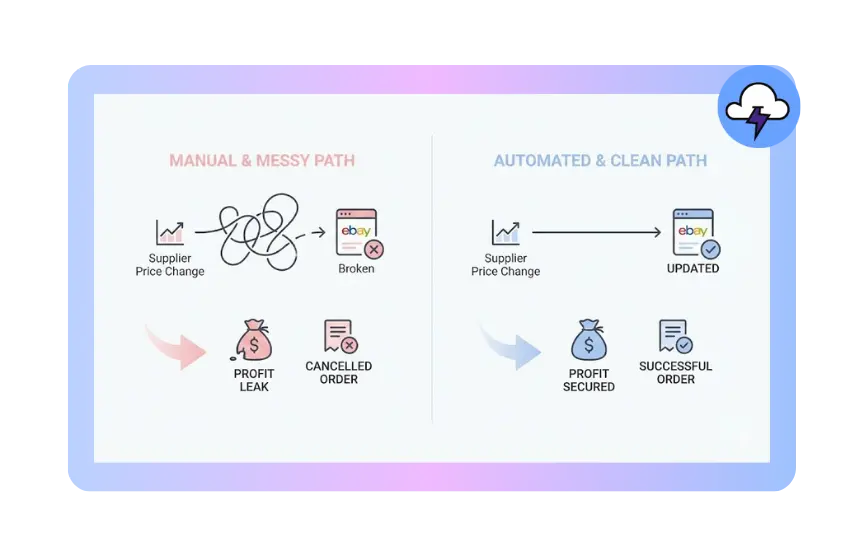

Manual price and stock checks only work when listing volume is extremely low. Once sellers manage dozens or hundreds of listings, human review cannot keep pace with real-time supplier changes.

Supplier price increases, sudden stock depletion, and overnight changes often go unnoticed until an order fails. This is why overselling and pricing errors are more common in growing stores.

In 2026, discipline alone is no longer enough.

Pricing Rules Matter More Than Individual Prices

Avoiding mismatches is not about setting the perfect price once. It is about defining rules that react when conditions change.

Sellers need pricing logic that accounts for:

- Supplier price movement

- eBay fees

- Desired margin thresholds

Understanding how pricing frameworks work is essential. This breakdown of pricing models in e-commerce that win explains how structured pricing reduces risk.

The Pro-Level Safety Buffer That Prevents Overselling

Experienced sellers in 2026 do not wait until stock reaches zero. They use a safety buffer.

A safety buffer means marking a product as out of stock before the supplier actually hits zero inventory. For example, setting a listing to unavailable when the supplier has two units left instead of zero.

This buffer protects against delayed supplier updates, late syncs, and sudden inventory changes. It is one of the simplest and most effective ways to prevent out-of-stock defects today.

Why Pricing Automation Is Now Essential

Pricing automation exists because manual systems break under real-world conditions. Not because sellers want shortcuts.

Automation applies seller-defined rules consistently, even when suppliers update prices multiple times per day. It reduces reaction time and removes guesswork.

This is why many sellers now rely on e-commerce price automation to stay compliant at scale. This guide on why dropshippers need e-commerce price automation now explains the shift clearly.

How SuperDS Helps Prevent Price and Stock Mismatches

SuperDS does not guess prices. It enforces seller-defined logic.

By following a structured Pricing Strategy Guide, sellers define how prices should behave when supplier costs change. SuperDS applies those rules consistently across listings.

This reduces cancellations, prevents overselling, and protects margins under current eBay standards.

Stability Comes Before Growth in 2026

Fast listing means nothing if orders fail afterward. Stable pricing and accurate stock awareness protect seller accounts and buyer trust.

In 2026, the most successful eBay sellers focus on control first, then scale.

Conclusion

Avoiding price and stock mismatches on eBay in 2026 is about operating within today’s rules, not predicting future changes.

By using pricing rules, safety buffers, and consistent stock awareness, sellers reduce transaction defects and protect their accounts. When pricing logic is applied correctly, growth becomes safer, more predictable, and sustainable.